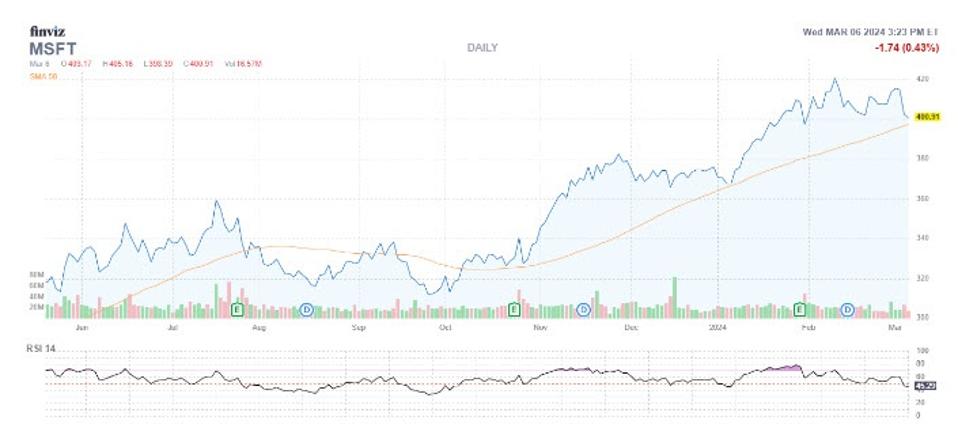

On Feb. 9, blue-chip tech titan Microsoft (MSFT) hit a record high of $420.82 and in the process became the most valuable publicly-traded company in the world. In the last month though, MSFT has traded in a tight range between $400 and $415. Despite this hesitation point and a 2.8% deficit in March already, Microsoft stock has pulled back to a historically bullish trendline.

The shares are within one standard deviation of their 50-day moving average. For the purpose of this study, Schaeffer’s Senior Quantitative Analyst Rocky White defines this pullback as the equity trading below the moving average for 80% of the time over the past two months, and closing south of the trendline in eight of the last 10 sessions. Per White’s data, seven similar signals have occurred during the past three years. MSFT was higher one month later after four of those signals, averaging a one-month gain of 4%. A similar move from the security’s current perch of $401.47 would have Microsoft knocking on the door of those record levels once more. While a 57% win rate isn’t necessarily a foolproof signal, given MSFT’s blue-chip status its prudent to think the stock won’t be on the mat for too long.

There’s a growing case the stock is drifting into ‘oversold’ territory. MSFT’s 14-day Relative Strength Index (RSI) has cratered since March and is now at its lowest level since early January. A RSI of 45 is still very middling, but the sharp drawdown from 60 in the span of just a few days shows that maybe the selloff has gone too far, too fast. And considering the $400 level has not been breached on a closing basis since Jan. 31, this psychologically-significant round-number level could step up as an additional layer of support.