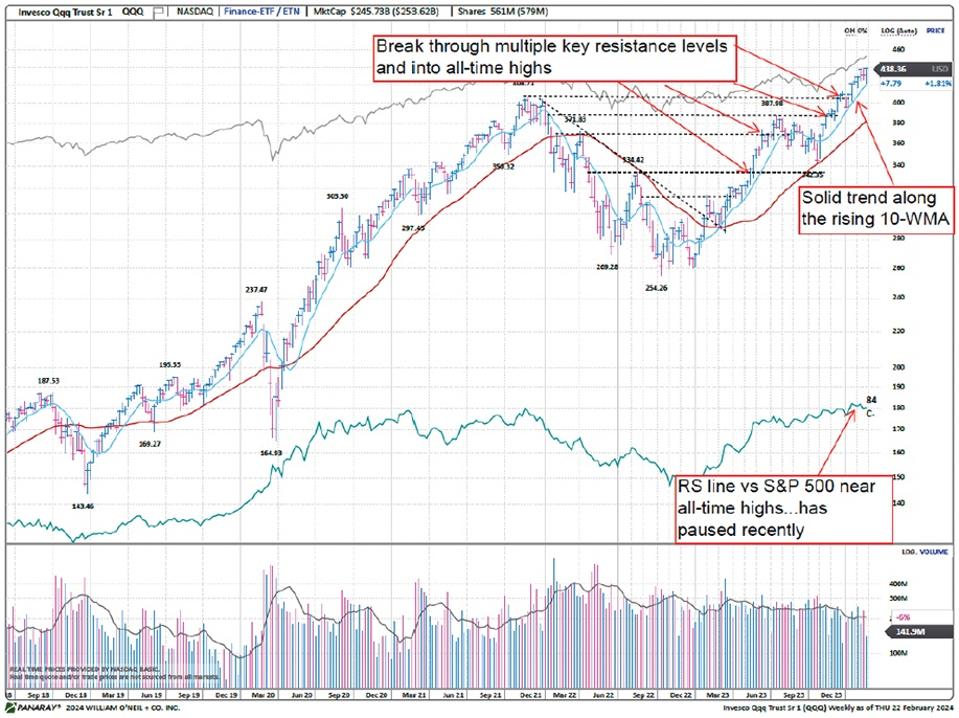

Since the US Federal Reserve suggested that its interest rate tightening cycle was ending last fall, the US stock market – particularly mega-capitalization Technology stocks – has been on an amazing run. The Nasdaq 100 (ETF: QQQ) has increased 27% from an intraday low of 342.35 to an intraday level of 434.80 on February 22 (See Figure 1 below).

Figure 1: Nasdaq 100 Weekly Chart

This run has led to some extreme disparities from both a capitalization as well as a market sector perspective. To start, as the tech-dominant top-10 stocks have ballooned in value, so has their weighting in the S&P 500. In 1990, Technology made up approximately 15% of the S&P 500. By 2000, it was 26% of the index. After dropping to a low of 16% in 2002, it then grew back to 25% by 2014. As of the start of 2024, the weight is at an all-time high 37% (including Telecom). This level of concentration inside the S&P 500 should be noted by investors as a possible market risk.

Figure 2: Nasdaq 100 and Russell 2000 Relative to S&P 500

Figure 2 above shows the Nasdaq 100 as a percentage of the S&P 500 as compared to the Russell 2000 as a percentage of the S&P 500. As the Nasdaq 100 (58% in Technology stocks at year end) has risen in relative terms, small stocks, as measured by the Russell 2000, have fallen. After a brief respite in the broad 2021 market rally, the Nasdaq 100 is back above its prior relative peak. This has affected small stocks dramatically, with the Russell 2000 having severely lagged the S&P 500 over the past almost three years. Its relative performance versus the S&P 500 is now at 23-year lows. This is reminiscent of the 1999–2000 Technology bubble, although we are not certain the bubble is peaking quite yet.

Another incredible fact regarding the structure of the current market is that the largest stock [either Apple

(AAPL) or Microsoft

(MSFT) – written before Nvidia (NVDA) surpassed them] is equal in worth to the entire market capitalization of the Russell 2000 Index. The top 10 stocks in the S&P 500 make up about five times the market capitalization of the Russell 2000 as shown in Figure 3 below.

Figure 3: Market Capitalization Breakdown

This gap between the Russell 2000 and the S&P 500 trailing one-year return is now more than 20%. This 20% underperformance threshold was clearly surpassed in the 1999–2000 Technology bubble, but outside of that instance, this is historically as extreme as this tends to get (See Figure 4 below).

Figure 4: Russell 2000 Relative Oscillator versus S&P 500

Similarly, the Russell 2000’s relationship to the Nasdaq 100 became much more stretched over the trailing one year in February, as seen in Figure 5. History shows that after the Internet bubble and the COVID year 2020, such extremes usually lead to some form of reversion in the relationship.

Figure 5: Russell 2000 Relative Oscillator versus Nasdaq 100

To no one’s surprise, the trailing one year has been one of exceptional Technology gains. The sector has doubled the S&P 500’s 22%+ gain, while outpacing all other sectors by 20–60% as shown in Figure 6. More conservative sectors like Consumer Staples and interest rate sensitive Utilities are actually down in absolute terms over the time period.

Figure 6: Sector Comparison Graph

This has led to a rare case of nearly every sector, save for Retail, being depressed not just versus Technology but the overall S&P 500. Figure 7 shows the trailing one-year oscillators of all 11 O’Neil sectors versus the S&P 500 going back to 1970. Oscillators are technical analysis tools that construct high and low bands between two extreme values and then build a trend indicator that fluctuates within these bounds. For these examples, sectors with negative values may be oversold. At the risk of repetition, this is reminiscent of the first interest bubble where non-Technology sectors lagged until the bubble burst. After that, many non-Technology sectors were the best performers for several years.

Figure 7: Sector Relative Oscillators versus S&P 500 and Nasdaq 100s

In 2,760 weeks of comparing this trailing one-year data, nine of the 11 sectors are in the range of historical extremes, using a 90% threshold (negative/neutral/improved is the change in late February compared to start of 2024).

- Basic Material’s 21% lag relative to the S&P500 over the last year has been worse in only 6% of all weeks. Negative in 2024.

- Capital Equipment: 7% lag has only been worse in 8% of all weeks. Neutral in 2024.

- Consumer Cyclical: 15% lag has only been worse in 7% of all weeks. Negative in 2024.

- Consumer Staple: 27% lag has only been worse in 2% of all weeks. Negative in 2024.

- Energy: 25% lag has only been worse in 9% of all weeks. Negative in 2024.

- Financial: 15% lag has only been worse in 7% of all weeks. Neutral in 2024.

- Health Care: 14% lag has only been worse in 9% of all weeks. Positive in 2024.

- Transportation: 16% lag has only been worse in 7% of all weeks. Neutral in 2024.

- Utility: 36% lag has only been worse in <1% of all weeks. Negative in 2024.

For the other two, Retail is not near an extreme either way, while Technology is stretched to the upside.

- Retail: 3% lead has been better in 44% of all weeks. Positive in 2024.

- Technology: 24% lead has been better in 7% of all weeks. Now neutral in 2024.

Very recently, some Technology leaders have finally begun to show signs of slowing down and consolidating their performance [Adobe

(ADBE

), Apple (AAPL), Alphabet (GOOGL), MongoDB

(MDB)]. We are keen to find other areas of the market that could benefit from a rotation of capital. Typically, when large-cap Technology begins to sell off or consolidate, the rest of the market follows suit. History may repeat this time but given the huge gaps in performance across most sectors as well as across the market cap spectrum (large vs. small), it is possible that rotation holds the broader markets intact. Either way, we think a reversion of performance of both smaller stocks and non-Technology sectors is likely to occur this calendar year. While the long-term prospects of Technology stocks remain impressive, too many other areas have been left behind in this rally. We think these areas will make up some of that performance differential as the year progresses.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, an affiliate of O’Neil Global Advisors, made significant contributions to the data compilation, analysis, and writing for this article.