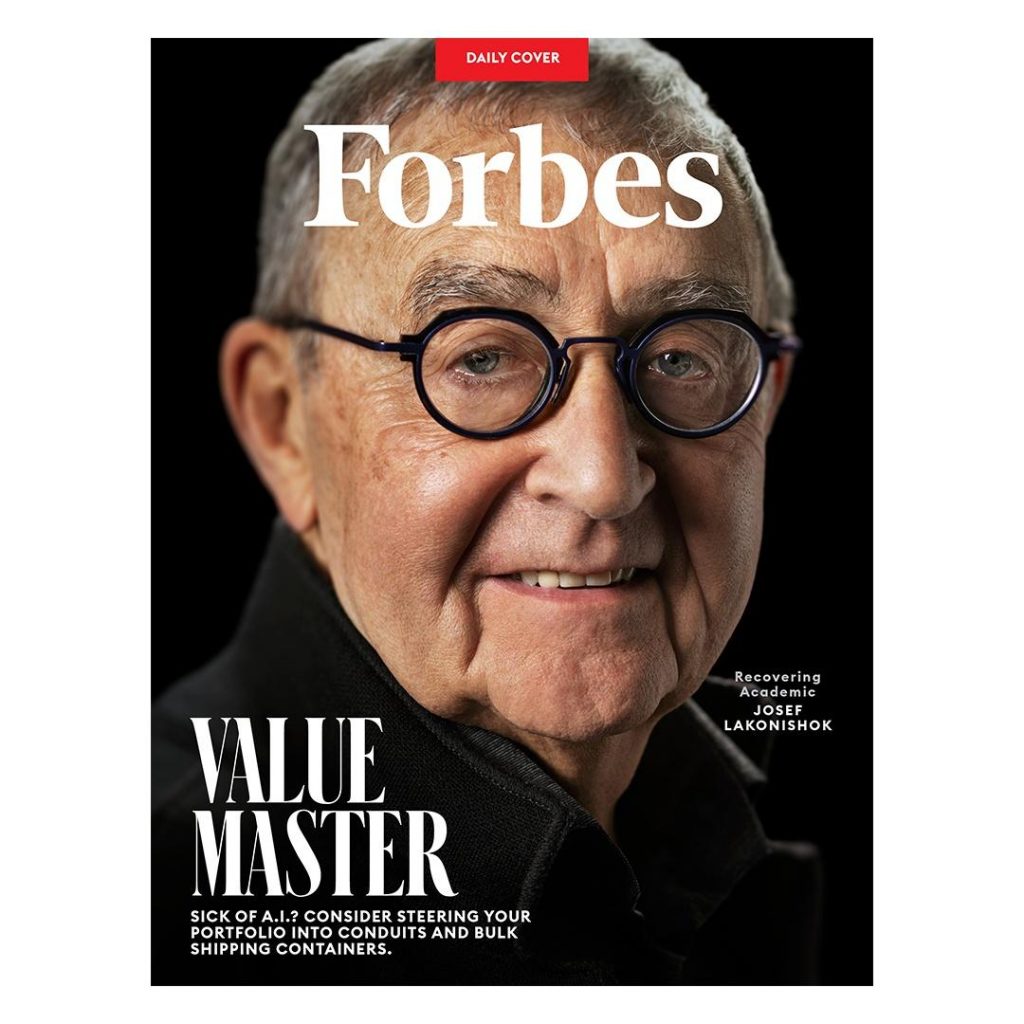

A simple rule from veteran market observer Josef Lakonishok: Don’t get excited about each new company boasting fantastic earnings growth.

Three professors publish a paper on a market anomaly: Over long periods, value stocks outperform growth stocks. What the hell, let’s try it, they say. So was born, 30 years ago, LSV Asset Management. It now has $96 billion to play with.

The Chicago firm offers 25 strategies, covering different slices of large, medium and small companies in North American, European, Asian and emerging markets. All the portfolios use the same recipe: Find uninteresting, slow-growing companies.

Josef Lakonishok, the ringleader of the trio and the L in the name, explains this approach with an example. He doesn’t like Nvidia, the outfit with a winning streak in chips for artificial intelligence, but he is in love with La-Z-Boy, which he describes as an “Archie Bunker” stock. LSV controls 4.4% of the lounge chair maker.

“I was always a contrarian,” Lakonishok says. “I never liked to be like everybody else.”

Value investing is scarcely a new thing. Indeed, the term contrarian has become a cliché since money manager David Dreman popularized it in a 1977 book. But few investors have the stamina to stick with out-of-favor stocks during a growth stock stampede. Value investing, Lakonishok says, works only 60 percent of the time.

Value is coming off a bad stretch. The past decade’s bull market has sent popularity contest winners Microsoft and Nvidia up tenfold and more, leaving the sleepy stocks LSV holds, like ExxonMobil and Comcast, far behind.

Among pension and endowment clients with separately managed portfolios, accounting for most of LSV’s assets, there are plenty with a very long view; LSV says their returns have averaged better than two percentage points a year above returns on relevant benchmarks. The retail crowd is less patient. For five years running, Morningstar figures, more assets have been departing from LSV’s seven mutual funds, now holding a collective $2 billion, than have arrived.

By William Baldwin

William Baldwin is Forbes’ Investment Strategies columnist.

When value buyers give up hope, cheap stocks get even cheaper. This phenomenon is most acute among smaller companies. Over the past 20 years, LSV calculates, the cheapest third of small companies have averaged a combined value equal to 12 times earnings, while the ratio for the most expensive third has averaged 61. (The latter figure is high in part because negative earnings are incorporated in the denominator.) Today those ratios are nine for cheap stocks and 113 for expensive ones.

In sum, if you must have the shares of a wannabe Tesla or some startup talking about AI, you pay a hefty price. And you are missing the chance to acquire such LSV gems as Atkore, an electrical conduit maker, at nine times earnings, or Greif, big in bulk shipping containers, at ten times.

Lakonishok had a Ph.D. from Cornell, scores of published papers and teaching stints at universities in North America and abroad when he cofounded LSV at age 47. His partners were Andrei Shleifer, a prominent Harvard economist who cashed out early, and Robert Vishny, a University of Chicago finance professor who is no longer active at LSV but retains an equity position.

Now 77, Lakonishok can look back on many a boom and bust. The tech bubble of 1998–2000 was a tough episode for the young firm. Oracle, Qualcomm and Yahoo climbed to 100 and more times earnings, making value stocks look foolish. “If it had continued for another year or two, we wouldn’t be around,” he says. “Close call.”

Lakonishok uses those words to describe another event in his life. When he was 13, his Lithuanian family was able to slip through the Iron Curtain only because of a loophole involving his mother’s Polish ancestry. The family settled in Israel. English was Lakonishok’s fifth language. He recalls struggling with an entrance exam because he didn’t know the words even and odd.

Ever cautious, Lakonishok didn’t quit his tenured professorship at the University of Illinois until 2004. He does not appear to need a salary now. All he will say about his LSV stake is that it is less than a third. Still, given the firm’s average fee near 0.4% and the overhead that would come from a staff of 43, one surmises that his family’s piece of the annual net runs well into eight figures.

The LSV take on a stock is, at core, numeric. Its analysts don’t visit companies. They paid scant attention to an intriguing asset at container manufacturer Greif: 175,000 acres of timberland left over from its days making wooden barrels. But they do massage the raw numbers.

Free cash flow, for example, is desirable, but the target must be adjusted for sales growth. What’s the formula? Lakonishok is not obliged to reveal it. He is no longer in the publish-or-perish sector.

He will say this, about both academia and Wall Street: Beware the data miners. They comb through stock market statistics, looking at 100 possible patterns, then zero in on the one that sticks out, even though it may be no less random than the other 99. The discovery is an excuse for either an article in a journal of finance or, as the case may be, a portfolio assignment.

Lakonishok has played this game. In 1992 he coauthored an entire book about the January effect, the supposed tendency of stocks beaten down by tax-loss selling to rebound after December 31. Turns out it’s hard to make money from this.

How are LSV’s methods any different from data mining? “We never did anything that didn’t make common sense,” Lakonishok answers. It’s common sense that people would become enamored of market stars, even as wise men going back to Benjamin Graham in the 1930s have warned them against this behavior. It’s common sense that investors would overestimate the ability of companies like Qualcomm in 2000 or Nvidia today to keep up a sizzling growth rate.

Lakonishok, who holds stocks for an average four years, has a second piece of free advice: “Investors that are lazy should be even lazier. They should trade even less.” If you dare to be a value investor, stay with it for 30 years.