A look at the company’s transformation into a global fintech powerhouse

By Yiannis Zourmpanos

Summary

- SoFi has evolved from a student loan provider to a major fintech entity, growing its member base from 1 million to nearly 7 million in three years.

- The company has diversified its offerings, including investment products and credit cards, with a focus on a “financial services productivity loop.”

- SoFi’s adoption of a bank charter has led to a more balance sheet-intensive approach, with assets growing to $28 billion and a strategic shift toward holding more loans.

- The company is on a path to GAAP profitability, with improving profit margins and marketing efficiency, alongside effective risk management in its expanding loan portfolio.

If you have been following SoFi Technologies Inc.’s (SOFI, Financial) evolution, you might recognize it as embodying the remarkable trajectory of a disruptive fintech company.

Initially established as a cost-effective student loan provider, SoFi has since evolved into a versatile financial solutions provider. Catering to a clientele of tech-savvy young individuals, the company aims to offer accessible and convenient financial services just a tap away.

The company has been growing its adjusted net revenue by 43.1% (year over year) on average every quarter for the last five quarters. The platform’s members (yes, they passionately call their customers members) grew from 1 million at the beginning of 2020 to nearly 7 million in the third quarter of 2023.

The reason for designating their customers as members stems from their strategy of onboarding and guiding them seamlessly to address their immediate financial concerns through a blend of data-driven insights and technological innovation—what SoFi terms a “financial services productivity loop.”

Upon securing a customer through deposit or lending products, the company seamlessly extends its offerings to include investment products, credit cards and features such as SoFi Relay, enabling customers to consolidate all their banking and financial account data on a single, convenient platform. As of September, the number of SoFi’s financial service products is 5.6 times that of its lending products.

Through its all-in-one financial service platform, SoFi grew its members by a compounded annual growth rate of 66.7% in the last three years. Membership will be on a high-growth trajectory in the coming years due to the network effect and multilayered value addition for customers.

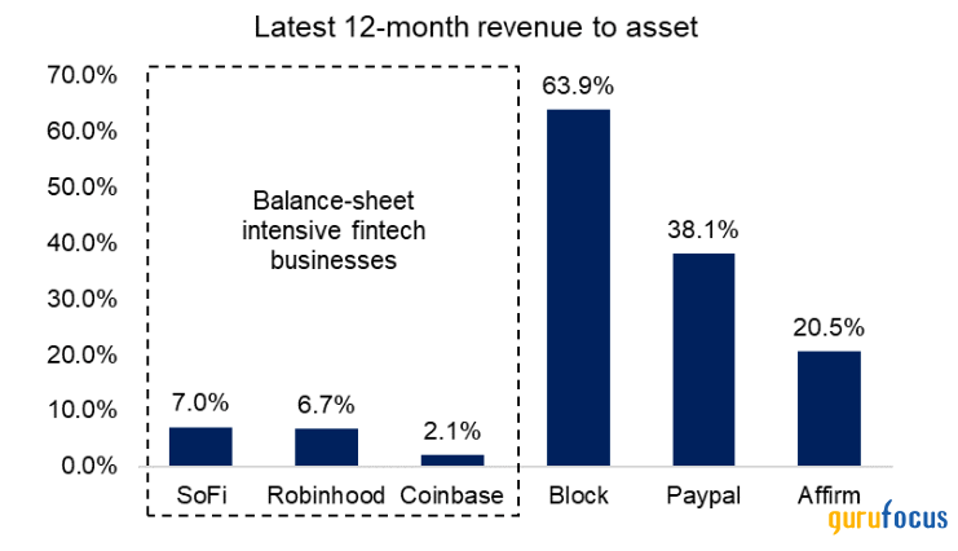

Additionally, SoFi is soaring to new heights, benefiting from the conventional asset-light fintech model, which typically scales without significant expansion of the asset book, achieving a revenue to asset ration of 7%. Comparatively, similar fintech companies such as Affirm (AFRM, Financial), Block (SQ, Financial) and Paypal (PYPL, Financial) maintain a revenue-to-assets ratio ranging from 21% to 64%.

In contrast, entities such as Coinbase (COIN, Financial), Robinhood (HOOD, Financial) and SoFi exhibit a lower revenue-to-assets ratio, ranging between 2% to 7%. Therefore, SoFi positions itself within the subset of balance sheet-intensive fintech businesses.

Source: Author’s compilation

SoFi has evolved into a comprehensive bank, embracing its bank charter and solidifying its identity as a financial institution infused with fintech DNA. This transition has rendered the company more balance sheet-intensive, exemplified by a remarkable 3.5 times growth in its asset book, reaching $28 billion over the past two years.

As a full-fledged bank, SoFi is now subject to regulatory requirements, necessitating a robust capitalization to support its expansion. Striking a delicate equilibrium between the scale and growth typical of fintech enterprises and the substantial capital foundation essential for banking operations, the company is expertly maneuvering through this juncture with a strategic pursuit of balance.

In the recent 10-Q earnings call, CEO Anthony Noto noted the lending side of the business will be additive to growth and the tech platform and financial services segments are the drivers of growth as they are low-capital businesses.

This statement signals management’s preference for growth emanating from low-capital ventures, yet the current driving forces of the business predominantly lean towards high-capital enterprises, notably in the lending sector. The business, still in its early stages of evolution, suggests a potential shift in this mix as it progresses.

SoFi’s revenue mix is changing as the net interest income has become the dominant factor in the revenue mix, reflecting the company’s strategic shift toward holding more loans rather than selling them. Loan sales to origination dropped to 6.80% during the third quarter compared to 57% in the first quarter of 2022, so there could be two reasons for holding on to the loans instead of selling them.

The first reason is that the management may have bought into the idea they may as well operate like a bank instead of just being a platform to originate loans and sell to others. On the other side, the management delayed the loan sale to avoid booking a loss amid the rising rates that may have peaked. Once the interest rates reverse downward, there will be a favorable opportunity to realize gains.

Source: Author’s compilation.

The company’s initial lending business model operated as an originate-to-distribute model, where SoFi originated the loans and then sold them for profit or transferred them through securitization. The efficacy of that model is now subdued, marked by a substantial decline in loan sales to origination over the given period.

Assets are now funded significantly by deposit, as SoFi has been able to source deposits with attractive offerings. As of September, interest-bearing deposits support 61.3% of earning assets, a notable increase from the 5.1% recorded in March 2022. Notably, this funding is more stable and primarily sourced from members. This shift serves a dual purpose by reducing the cost of funds and empowering SoFi with greater control over sourcing funds for its asset expansion.

Finally, SoFi’s journey toward a full-fledged bank is pushing up its asset base, but at the same time, the need to make the bank well-capitalized is rising.

In the latest 10-Q earnings call, management emphasized the path to GAAP profitability by the last quarter of 2023 and in the coming years. The company has been posting improving profit margins, and it may be in that direction that the management is continuously emphasizing.

Its dominant revenue mix is now net interest income. Due to declining funding costs and growing contributions from high-yield personal loans, the net interest margin has been trending upward. NIM stood at 5.99% during the third quater of 2023 compared to 5.86% a year earlier.

The company is also achieving marketing efficiency. As of the latest quarter, marketing expense per new member declined 17% quarter over quarter and 32% year over year. As a result, SoFi improved its Ebitda margin by 700 basis points to 18% from a year earlier.

Around 1980, a reporter asked Howard Marks (Trades, Portfolio), who built his success on finding great investment bargains in distressed assets, “How can you buy high-yield bonds when you know some of the issuers are going to default?” Marks replied, “How can life insurance companies insure people’s lives when they know they are all going to die?”

The guru used the phrase “intelligent bearing of risk for profit” to state that an investor is not wrong in taking a risk when that risk is quantifiable, manageable and profitable.

Many may look at SoFi’s aggressive loan book expansion and say it is risky. Risk becomes a problem when the company fails to manage it well. SoFi has been efficiently managing its credit risk, and the bank’s lending consists of student, personal and home loans. Similarly, personal loans stand out as the predominant catalyst on the lending front, representing a high-yielding segment within the loan portfolio.

Remarkably, FICO score across all segments remains strong. As of September 2023, the weighted average origination FICO of personal, student and home loans stood at 744, 781 and 755. Meanwhile, increasing the user base in SoFi Relay (a source of all users’ financial data) gives the company a significant data advantage to process credit grading and manage risk efficiently.

SoFi has effectively maintained a strong Tier 1 capital position. Despite a declining trend in the capital ratio, it consistently exceeds the minimum requirement. The challenge inherent in a loss-making bank lies in the potential limitation of capitalization to sustain long-term loan book growth.

Lastly, as the company is on the path to profitability and loan sales are likely to resume when the interest rate environment turns favorable, the ratio will improve in the coming quarters.

Source: Author’s compilation

SoFi’s evolution from a niche student loan provider to a dynamic fintech and banking leader showcases its innovative growth, strategic risk management and robust capitalization.

Finally, embracing a balance sheet-intensive approach, SoFi is poised for future scalability and profitability, blending fintech agility with traditional banking’s solidity, reshaping the financial services landscape.

I am/we currently own positions in the stocks mentioned, and have NO plans to sell some or all of the positions in the stocks mentioned over the next 72 hours