To avoid a collision someone normally blinks in a game of chicken, which is what appears to have happened in a $30 billion race by two of the world’s biggest mining companies competing to become the world’s next major producer of potash.

British-based Anglo American and Australia’s BHP have both identified potash, an important crop nutrient, as a business which complements their mining skills while also offering growth potential as demand for food rises.

But success in potash means finding a way into an already crowded market for a product with a track record of sharp price movements and which is heavily dependent on seasonal demand and the ability of farmers to pay.

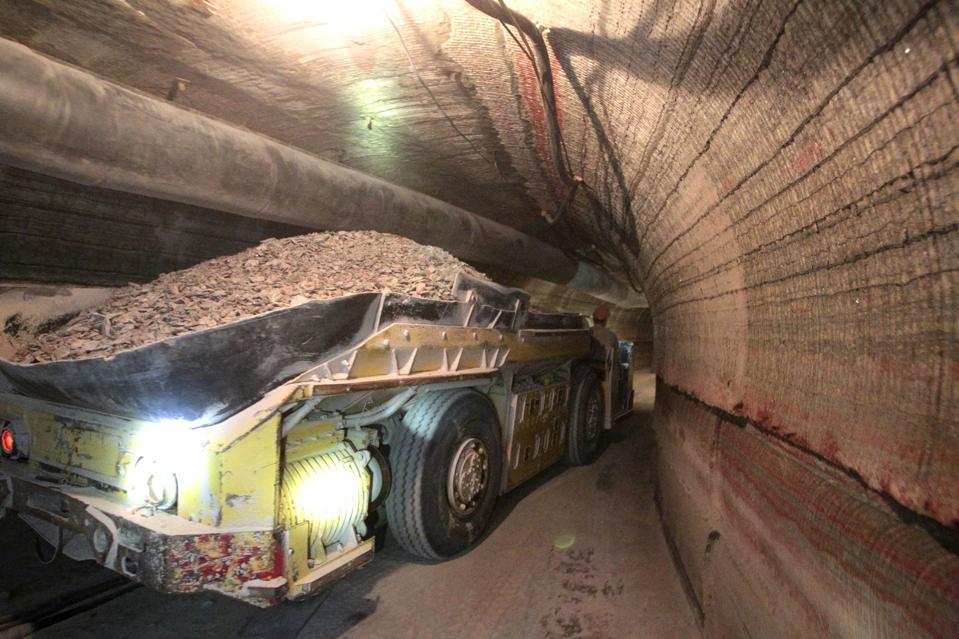

Anglo American, better known as the owner of the De Beers diamond business, along with copper, platinum and coal mines, is pinning its potash hopes on the Woodsmith mine in the British county of Yorkshire.

BHP is focused on the Jansen project in the Canadian prairie province of Saskatchewan.

If fully developed each project could cost close to $15 billion, a stretch for Anglo American which is feeling the pinch in its diamond, platinum and iron ore divisions, forced last week to reveal a plan to cut future capital investment by $1.8 billion.

Costs squeeze

Woodsmith has dodged the cuts for now, but the company warned that spending “beyond next year” would be subject to board approval, a sign that management is uneasy about a full-blooded commitment to the project.

BHP, on the other hand, is in no doubt that its full steam ahead at Jansen with the board approving in October a $7.7 billion budget for the second stage of the project before the first stage ships a ton of potash.

In effect, Anglo American has blinked in its race against BHP to add a “green” commodity to its traditional crop of mined material.

Multiple factors could have caused Anglo American to become the cautious player in the high stakes potash race, including a steep fall in the price of the fertilizer following a boom last year caused by fear of an interruption of exports from Russia after it invaded Ukraine.

But a problem specific to Anglo American’s Woodsmith project is that it is producing a unique type of potash called “polyhalite” (many salts) which is yet to be fully accepted by farmers or able to demonstrate a significant advantage over conventional potash.

Investors have been wary of Woodsmith since it was acquired by Anglo American from the financially stressed Australian company Sirius Minerals for $530 million in early 2020.

Woodsmith Rescue

Despite attracting strong local support and a number of high-profile supporters, Sirius was unable to complete the first stage of a complex development while also being unable to prove the benefits of polyhalite over other forms of potash.

The latest concern over the cost of developing Woodsmith and the tight potash market comes at the same diamond and platinum prices have been falling and copper production declining.

That combination of factors has fed into a share price correction and speculation that Anglo American could be a takeover target.

Over the past month the company’s share price has dropped by 15%, taking its fall over the past 12 months to 46%. Archrival BHP has gone the other way with a 5% share price rise over the past month (and up 3% for the year).

Anglo American chief executive, Duncan Wanblad said in a trading update last week that capital expenditure would be cut by $1.8 billion as part of a cost cutting campaign in order to “improve the company’s resilience”.

News of the cost cuts did nothing for Anglo American’s share price which fell by 22% in the days after the announcement, sparking speculation that bidders for the century old business with deep South African roots might be circling.