It’s hard to believe that this time last year, the fact that real GDP had fallen for two consecutive quarters was fueling fears that a recession was on the horizon. But not only did the expected downturn never materialize, the data for 2023Q3 show the fastest growth in almost two years. How did the economy dodge that bullet?

Easy, it turns out there wasn’t a bullet in the first place.

It is true that the economy contracted. In 2022Q1, the rate of growth of real GDP was -1.98% and in 2022Q2, it was -0.56% (annualized). But that’s only a recession if the National Bureau of Economic Research (NBER)—the private-sector research group that officially dates the business cycle—says so. They didn’t, and they had good reason.

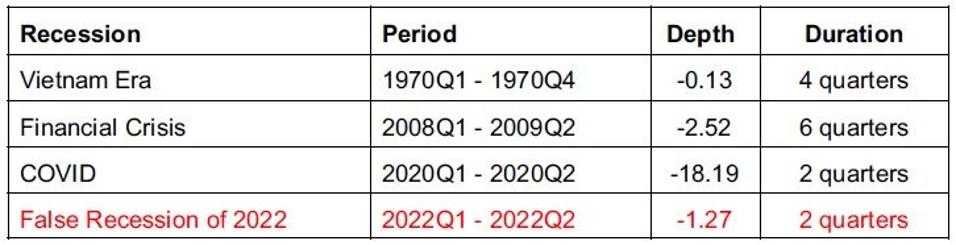

The NBER employs a set of subjective but fairly reasonable criteria that center around depth (how bad was it?), diffusion (how broadly-based was it?), and duration (how long was it?). If an episode does not satisfy those, it does not qualify. To see why they excluded 2022Q1 to 2022Q2, compare what was happening then to some earlier contractions (data from FRED database):

I’ve omitted diffusion on the assumption that each of the above—including the false recession—was national in scope. Depth is measured as the average rate of real GDP growth for the entire period and duration is in quarters (although the NBER actually marks recessions in months—data limitations, specifically GDP, forced me to opt for quarters).

You can see here that the downturn in the first half of 2022 was relatively mild compared to those that followed the Financial Crisis and COVID. And while 2022 was actually quite a bit worse than 1970, it was half as long. So one could make the argument—and it’s an argument, not a conclusion, since the NBER uses guidelines rather than a hard-and-fast rule—that, by one criterion or another, early 2022 fails to qualify.

But there is more to it than that. It’s also necessary to look at the cause of the downturn. If it’s obviously something ephemeral, then perhaps the economy has only hit a pothole and we’ll soon be on our way again. That appears to have been the case in the worst of the two quarters (2022Q1), when real GDP growth was -1.98%.

Breaking down the various contributions to GDP (each measured in percentage points so that they sum to the overall rate of growth), you find the following (data from FRED database):

Physical investment spending, which is usually the driver of the business cycle, actually contributed positively. And while all three other components were a net drag, it is clear that the real culprit was Net Exports. This was in turn driven by a historic jump in imports, a function of the fact that “businesses who are worried about shortages front-loaded imports after Russia’s invasion of Ukraine.”

As one might expect, this was a short-term phenomenon. Indeed, two quarters later the contribution of net exports was +2.58, almost exactly offsetting that earlier historic number. In fact, that category has contributed to positively to GDP growth every subsequent quarter but the most recent, when it was -0.04 of the overall 5.16%. The NBER was right: it was a temporary hitch.

Personally, I’ve actually been much more concerned about investment spending, which has contributed negatively in three of the last six quarters. However it, too, has recovered. And so we enter the fourth quarter with a slightly rising but still enviable rate of unemployment and no clear downward trends in any of the variables that drive GDP.

A recession really wasn’t looming in 2022, nor is one now.