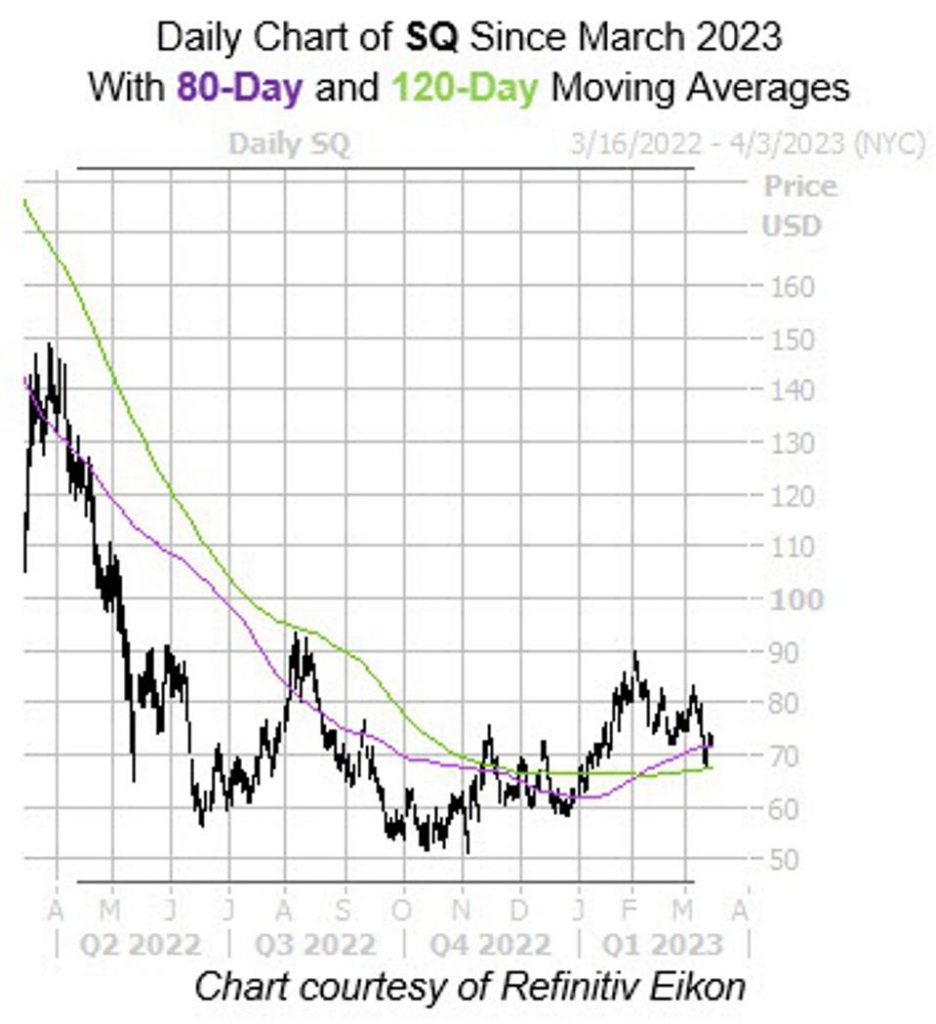

Block (SQ) stock ran into a ceiling at the $90 level in early February, after chopping higher most of January to hit its highest level since August. The equity still sports a 16.2% year-to-date lead, with support from the 120-day moving average containing its latest pullback. Even better, shares are now trading near of trendline with historically bullish implications.

SQ is within one standard deviation of its 80-day moving average, after a brief dip below it. According to Schaeffer’s Senior Quantitative Analyst Rocky White’s most recent study, the security saw four similar signals over the last three years, and was higher one month later 50% of the time to average a 7.1% gain. A comparable move from its current perch would place the equity just shy of $78.

Short-term options traders have been overwhelmingly bearish, indicating a shift in sentiment could boost the shares. This is per Block stock’s Schaeffer’s put/call open interest ratio (SOIR) of 1.71, which stands in the 92nd percentile of annual readings.

It’s also worth noting that premiums are attractively priced at the moment, making this an opportune time to bet on the stock’s next moves with options. This is per SQ’s Schaeffer’s Volatility Index (SVI) of 27%, which stands at the low 16th percentile of readings from the last 12 months.